Barney Hong 洪玮

Quantitative Researcher

GROW Asset Management (HK) Limited

Biography

Wei Hong is a Shanghai/Hong Kong-based quantitative researcher at GROW Asset Management (HK) Limited, specializing in the Chinese A-share market. He architects and validates low-latency C++ trading infrastructure, researches systematic alpha factors, and collaborates with traders to productionize resilient execution workflows.

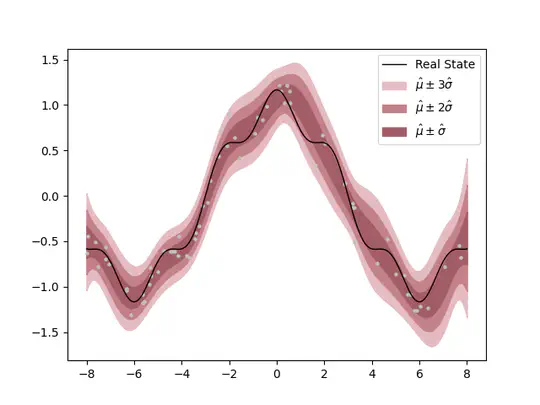

Barney earned an MSc in Mathematical Sciences with distinction from the University of Oxford after graduating with distinction in Mathematics from the University of Manchester. His interests span Bayesian inference, Monte Carlo methods, and model-driven portfolio construction, anchored by advanced statistics and high-performance computing.

He works primarily in Python and modern C++, applying statistical learning methods, probabilistic programming, and database engineering to support intraday and mid-horizon research pipelines.

- Numerical Analysis

- Deep Learning

- Bayesian inference

- Monte Carlo methods

- Inverse Problems

- Non-parametric & Semi-parametric Methods

MSc in Mathematical Sciences, 2022

University of Oxford

BSc in Mathematics, 2019

University of Manchester

Experience

- Direct research into Chinese A-share market microstructure, alpha factors, and portfolio construction signals.

- Engineer and optimize low-latency C++ trading components, ensuring deterministic performance in exchange co-location environments.

- Partner with trading and infrastructure teams to productionize systematic strategies and improve execution resilience.

- Involved in project one: Quantitative Market Timing Based on Mahalanobis Distance to Build Stock Investment Strategy; project two: Fund Investment Strategies Based on Past Returns.

- Project one: Measured data similarity instead of relativity, identified market trends by the MACD indicator (the DEA line), the accuracy rate of measuring historical market hit 70%.

- Project two: assisted in the reproduction of Clifford S. Asness’ Strategy from the Power of Past Stock Returns to Explain Future Stock Returns, during which the period of market/investment timing was shortened to the weekly unit and the calculation of R square was used to do the evaluation for forecasts.

- Responsible for the weekly report writing with data extracted from Wind (including stock market indexes, futures exchange rates, etc) and the follow-up data analysis.

- Core duties: web crawling, database management, internal web tooling, data visualization, and analytics.

- Philips marketing analytics project: engineered cross-platform crawlers (Taobao, JD.com, Douyin) and built NLP pipelines to analyse consumer sentiment and purchase motivation for campaign planning.

- Built an intranet dashboard backed by automated data ingestion, delivering reusable histogram and scatter visualizations for the analytics team.

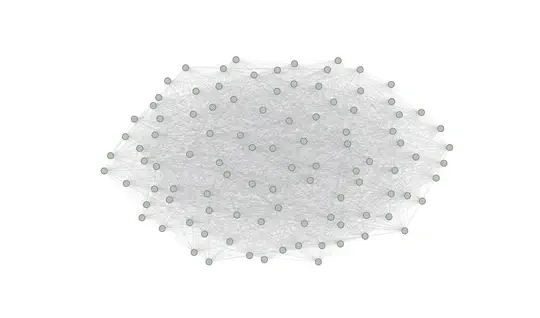

- Assisted the development of recommendation system algorithm for social network services and that of data mining techniques for customer relationship management.

Research Highlights

- Intraday alpha library – Designed and evaluated a suite of short-horizon factors for CSI 300 constituents, combining microstructure signals with machine learning stability checks.

- Low-latency execution stack – Architected deterministic C++ order gateways deployed in Shanghai co-location, cutting tail latency by >25% while maintaining strict risk controls.

- System resiliency analytics – Built Python diagnostics to monitor slippage, venue health, and factor decay across live portfolios, providing daily feedback loops to trading teams.

Activities

Projects

Contact

I welcome conversations about quantitative research, systematic trading, and collaboration opportunities. Reach out via email or phone and I will respond as soon as possible.